Macroeconomics vs. Microeconomics

- Macroeconomics: the study of the economy as a whole.

- minimum wage

- international trade

- supply and demand

- Microeconomics: the study of individual or specific unit of economy.

Positive Economic vs. Normative Economics

- Positive economic: claims that attempt to describe the world as is.

- Collects & presents facts

- Normative economic: claims that attempt to prescribe how the world should be.

- "Ought to be" and "should be" opinion

Needs vs. Wants

- Needs: basic requirement for survival (food, water, shelter, clothes)

- Wants: desire of citizens

Goods vs. Services

- Goods: tangible commodities

- Capital good: items used in creation of other goods such as factory machines and trucks.

- Consumer good: goods that are used for consumers.

- Service: work that is performed for someone.

Scarcity vs. Shortage

- Scarcity: the most fundamental economic problem that all societies face. Were trying to satisfy unlimited wants with unlimited resources.

- Shortage: quantity demanded is greater than quantity supply.

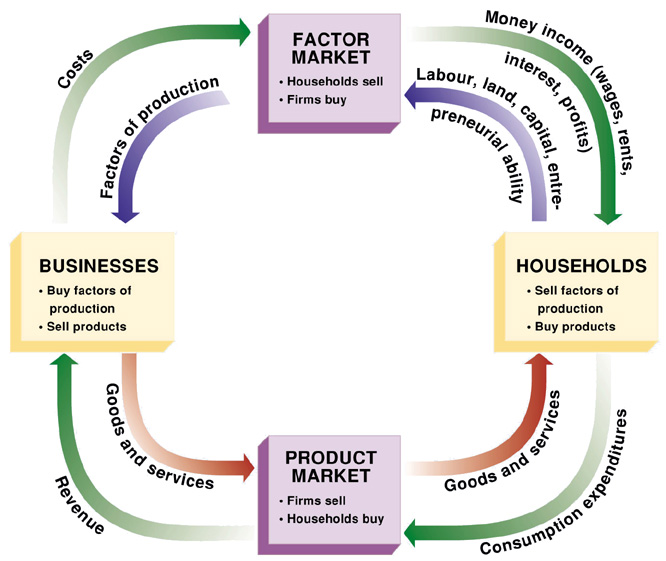

Factors of Production

Resources required to produce goods and services.

- Land-natural resources

- Labor-work force

- Capital

- Physical capital (tools, machinery, robots, factories)

- Human capital (skills, talents, and knowledge)

- Entrepreneurship

Trade-offs: alternatives that we give up whenever we chose one course of action over another.

Opportunity cost: form of trade-off. Next best alternative.

Production Possibility Curve (PPC)

It showed alternative ways in how to use a country's resources.

Four Assumptions of PPG

- Two goods: resources are used to produce one or both of only two goods.

- Fixed resources: the quantities of land, labor, capital, and entrepreneurship resources do not change.

- Fixed technology: the information and knowledge that society has about the goods and services is fixed..

- Technical efficiency:

Efficiency

Using resources in such a way in maximize the production of goods and services

- Allocative efficiency: the products being produced are the ones being desired by society.

- Productive efficiency: products are being produced in the least costly way.

- Under-utilization: using fewer resources than the economy is capable of using.

What Causes the PPC to Shift?

- Technological change

- Change in resources

- Economic growth

- Change in the labor force

- Natural disasters/war/famine

- More education (human capital)

Elasticity of Demand

A measure of how consumers react to a Δ in price.

- Elastic Demand: demand that is very sensitive to a Δ in price. The product is not a necessity and there are available substitutes. E > 1

- Inelastic Demand: demand that is not very sensitive to a Δ in price. The product is a necessity, there are a few substitutes and people will buy no matter what. E < 1

- Unit/Unitary Demand: E = 1

Cost of Production

- Total Revenue: the total amount of money a firm receives from selling goods and services. P x Q = TR

- Fixed Cost: a cost that does not change no matter how much of a good is produced.

- Variable Cost: a cost that rises or falls depending on how much is produced.

- Marginal Cost: the cost of producing one more unite of a good. TCnew - TCold

- Formula:

- TFC+TVC=TC

- AFC+AVC=ATC

- TFC/Q=AFC

- TVC/Q=AVC

- TC/Q=ATC

- TFC=AFC x Q

- TVC=AVC x Q

Price Elasticity of Demand (PED)

Step 1: Quantity (New quantity - Old quantity)/Old quantity

Step 2: Price (New price - Old price)/Old price

Step 3: PED (% Δ in quantity demanded)/% Δ in price

Supply and Demand

- Supply: the quantities that producers or sellers are willing and able to produce at various prices.

- Law of Supply: there is a direct relationship between price and quantity supply.

- Change in Supply:

- Δ in expectation

- Δ in weather

- Δ in # of suppliers

- Δ in cost of production

- Δ in taxes or subsidies

- Δ in technology

- Demand: the quantities that people are willing and able to buy at various quantities.

- Law of Demand: states there is an inverse relationship between price and quantity demanded.

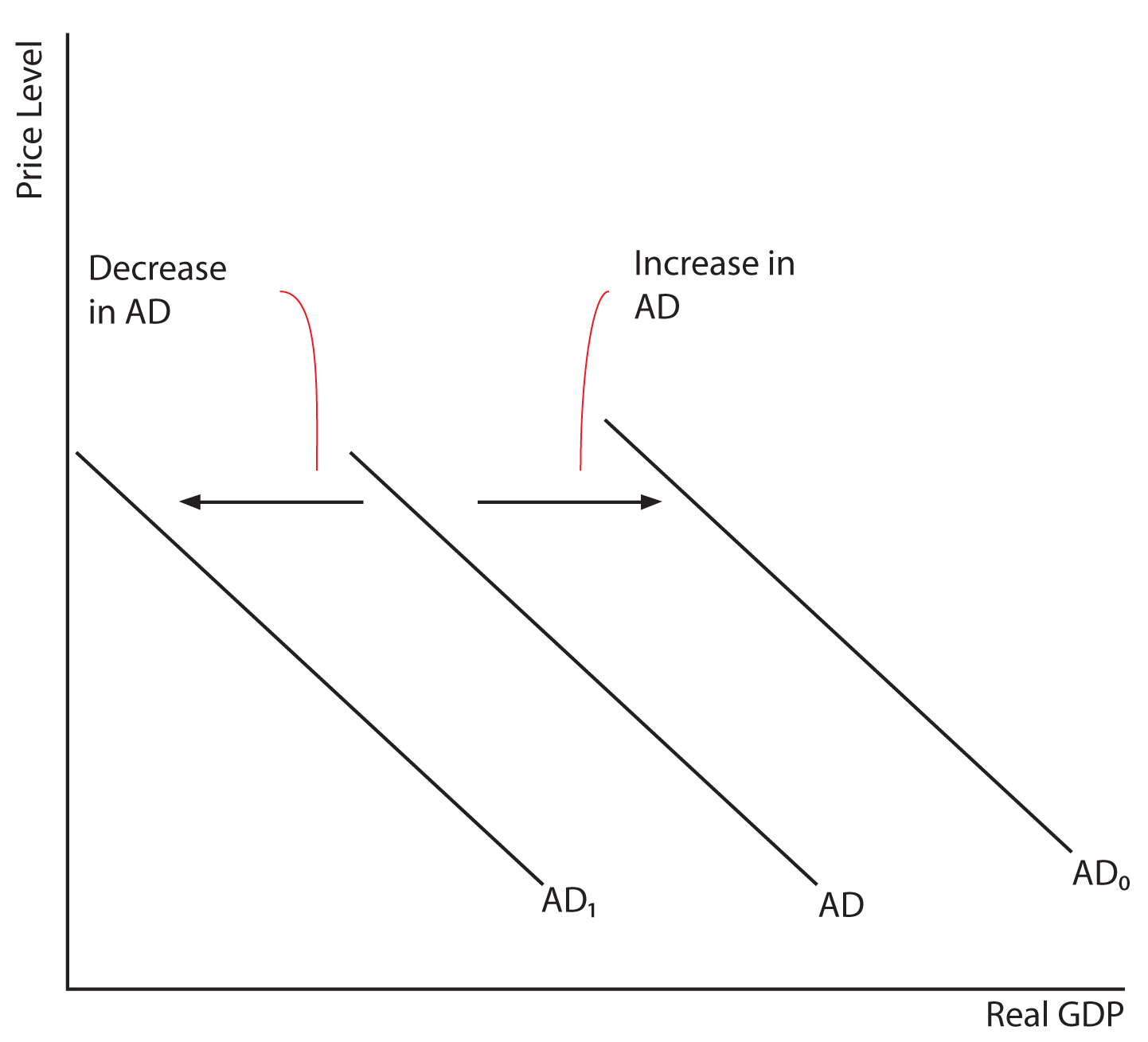

- Change in Demand:

- Δ in buyer's taste (advertisement)

- Δ in # of buyers (population)

- Δ in price of related goods

- complementary goods

- substitute goods

- Δ in income

- normal good: an increase in income that causes an increase in demand.

- inferior good: an increase in income causes a fall in demand.

- Δ in expectation (future)

- Equilibrium: the point at which the supply curve and the demand curve intersect. All resources are being efficiently used.

- Excess demand: occurs when the quantity demanded is greater than the quantity supplied.

- Price ceiling: occurs when the government puts a legal limit on how high the price of a product can be.

- Excess supply: occurs when the quantity supplied is greater than the quantity demanded.

- Price floor: the lowest legal price a commodity can be sold at.